Mobile Banking That Works Wherever You Do

Our Business Mobile App gives you the freedom to manage your finances on your schedule—with tools designed to keep your business moving.

Secure Access Anywhere

Log in safely from your phone or tablet—anytime, anywhere.

On-the-Go Approvals

Authorize transactions and payments when you’re out of office.

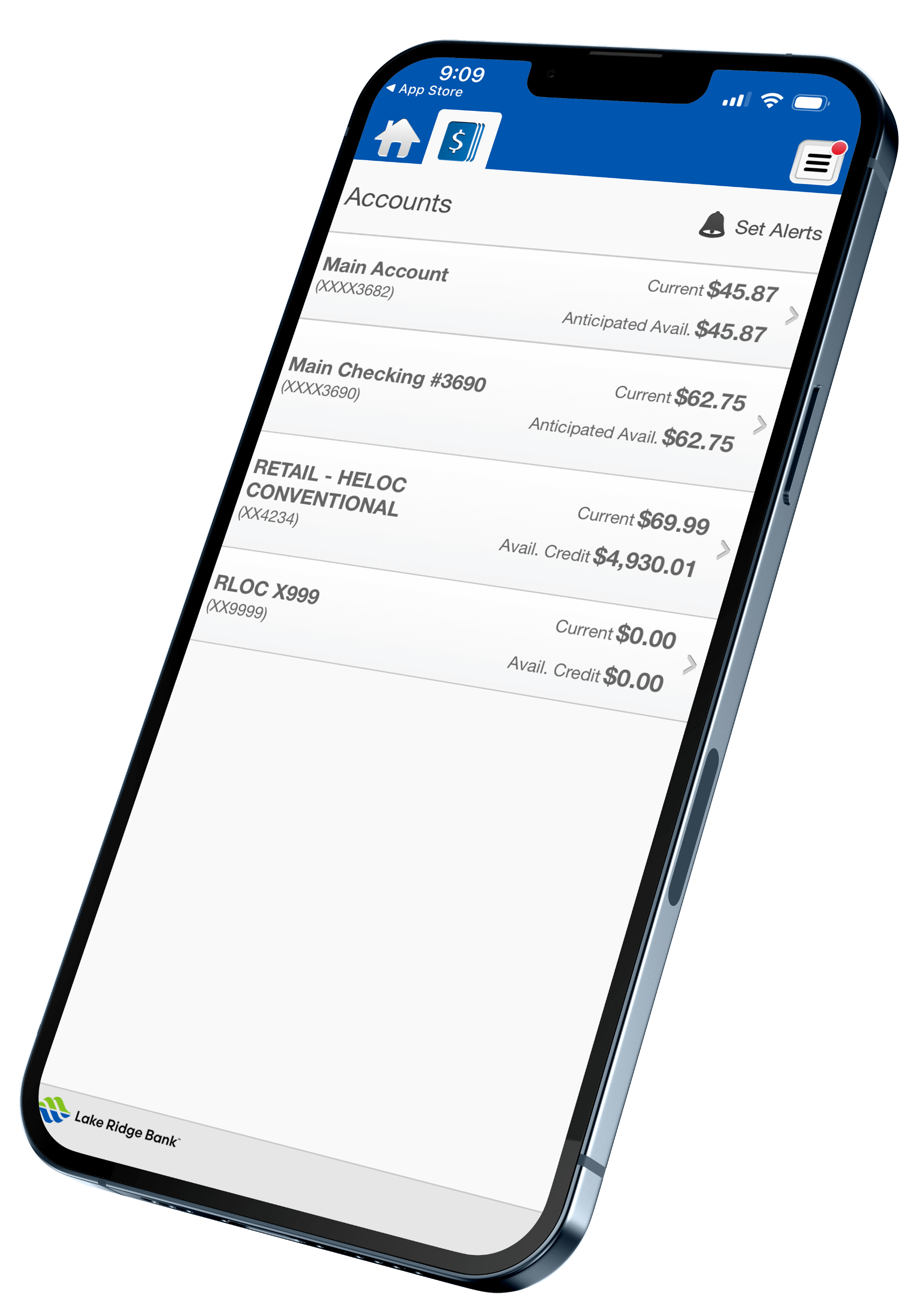

Account Management

Check balances, view history, and transfer funds with ease.

Mobile Bill Pay

Pay bills straight from the app, no matter where you are.

Real-Time Alerts

Monitor your credit score without hurting it.

Simple & Intuitive

Designed for busy business owners, not tech experts.

Local Support

Questions? Our team is just a call away.

Frequently Asked Questions

How do I set up mobile alerts from Online Banking?

Can I set up alerts in the mobile app?

How do I enroll in Business Mobile Banking?

What are my login credentials for the Business Mobile app?

Is there a cost to use Business Mobile?

Market Report: February 2026

Meet Your Business Banker: Jessica Sarbacker

Protect Your Operating Account: Why Business Credit is the Smarter Choice