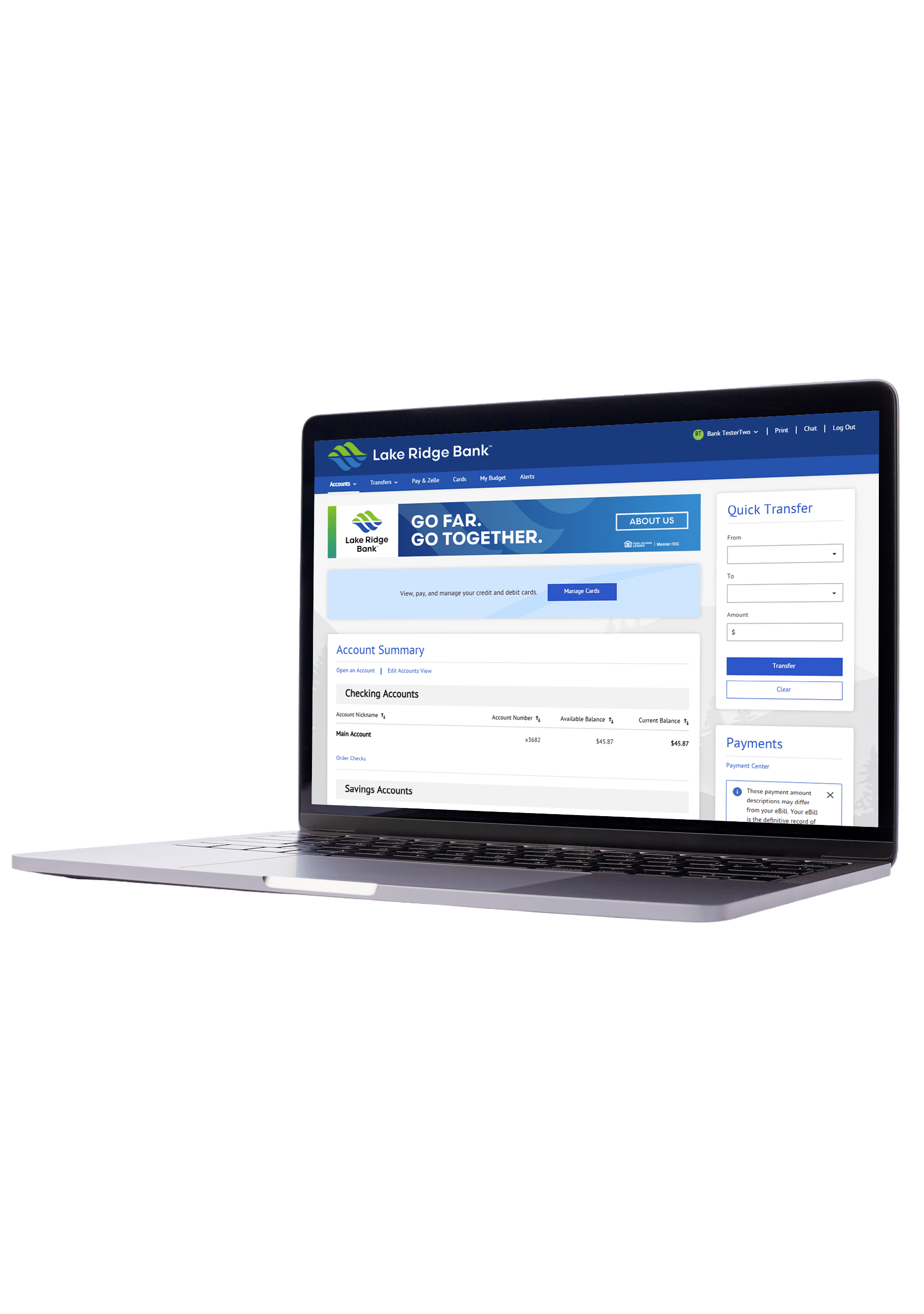

Online Banking

Manage your finances anytime, anywhere. Access real-time account balances, pay bills, transfer funds, and more—all from the comfort of your home or on the go.

Bank Smart, Wherever You Are

Lake Ridge Bank’s online banking gives you the freedom, security, and control to manage your money—anytime, anywhere.

24/7 Access

Bank on your schedule, wherever life takes you.

Better Money Management

Bank on your schedule, wherever life takes you.

Fewer Fees

Avoid late payments with easy online bill tools.

Peace Of Mind

Set alerts and go paperless for added security.

Stay Credit-Savvy

Monitor your credit score without hurting it.

Frequently Asked Questions

Is my information secure when using Zelle?

How to get started with Zelle in our mobile app?

- Enroll or log in to Mobile or Online Banking

- Select “Zelle”

- Accept Terms and Conditions

- Select your U.S. mobile number or email address and deposit account

I’m unsure about sending money to someone I don’t know. What should I do?

What are some simple tips to ensure your money sent safely?

- Know who you are sending money to – Only use Zelle to sned money to friends, family, and other people you trust.

- Verify that your recipient’s name, U.S. mobile phone number and email address are correct before sending money.

- Be Aware – If a payment situation feels off, it probably is. Trust your get and investigate before sending money.

Do you offer a budgeting tool?

Market Report: February 2026

Meet Your Business Banker: Jessica Sarbacker

Protect Your Operating Account: Why Business Credit is the Smarter Choice