Understanding Mortgage Rates: Did You Miss the Window?

For those who didn’t purchase or refinance last year, you might be feeling like you missed the boat on low mortgage interest rates. Current rates may be making people experience a bit of sticker shock comparatively. Is it too late to take advantage of the low-rate trend?

The answer is no … relatively speaking. The key is to understand how mortgage rates work and to control the variables you can.

A Look at the Math

Current rates on 30-year fixed rate loans are floating between 3.75% and 4%, depending on the day. With perfect timing, the same situation might have been 2.75 or 3% in 2021. This can be very concerning for folks. Let’s put it into perspective by reviewing historical rates and doing some math.

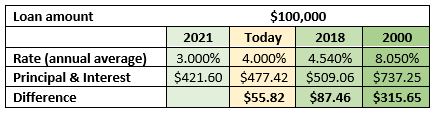

Between 2010 & 2021, the annual average 30-year mortgage rates have been as low as 3% (2021) and as high as 4.54% (2018), so fluctuation is normal.

In 2000, the average annual rate was 8.05%. Of course, homes cost more now — more than twice as much. And incomes were lower then — $42,000 in 2000 compared to $67,500 in 2020 (national median income). While we have higher home prices and higher mortgages, we also have lower rates and higher incomes.

Clearly, all things are not equal, but we can still easily compare situations. Let’s look at the payments for a $100,000 mortgage with the 2021 average as our base:

Most of us don’t have exact $100,000 mortgages, so we can just multiply or divide as needed. For example, if you have a $200,000 mortgage (or plan to get one), the payment will be $112 more per month compared to last year. Not fun to pay more, but perhaps not as bad as you thought.

Why Have Rates Gone Up?

There are multiple factors that affect rates. Some are tied to economic issues nationally and internationally. Some are things you can control or improve on your own.

- 10-year Treasury bill rate: When this rate goes up, mortgage rates tend to do the same.

- Investor confidence: Good or bad economic news tends to drive rates in the opposite direction. When there are concerns for the economy, investors are likely to go to “safe-haven” investments like Treasure bills and mortgage bonds (explained below).

- Inflation: When inflation is low, as it has been since 2011, mortgage rates trend lower. Inflation has been going up, so mortgage rates are following.

- Your personal situation: The best rates are for the best borrowers and best scenarios. Borrowers with good credit and stable financial history have the least risk of default.

In addition, mortgage bonds can affect your rate. When you get a mortgage, the money comes from the lending institution. A bank or credit union only has so much money to lend, so the mortgage itself is often sold to Fannie Mae or Freddie Mac. They, in turn, package those mortgages into “mortgage-backed securities.” Investors buy these securities in the form of shares. This keeps mortgages far more available and rates lower.

A note about servicing: While the loan may be sold to Fannie or Freddie, the servicing — the people who manage your loan — can stay with the original lender (like Lake Ridge Bank) or be sold to any number of other organizations … multiple times. You want to know who you’re going to be working with tomorrow, next year, and 10 years from now so be sure to ask. Local loan servicing provides more flexibility and convenience thanks to those local relationships.

What Can You Do?

Many people try to find the best interest rate available for their mortgage. You can shop rates, but make sure you are comparing apples to apples. For instance, watch for closing costs and points charged by the lender. Rates change constantly, so until you’re ready to lock in your loan rate, it’s just information. Also consider who you’ll be working with long term (see note about servicing).

That said, there are things you can do to give yourself the best rate possible. The most important things you can do are:

- Keep your credit score high – Pay everything on time. One missed mortgage payment can drop your score as much as 100 points. Even when brought up to date, the late payment or collection item will continue to affect your credit score for the next few years and stay on the credit report for up to 7 years.

- Be careful about applications for credit – It’s fine to ask about rates and costs but be careful about doing actual applications. Keep it to 3 mortgage applications within 2 weeks. Now is not the time to shop for a car or get a credit card.

- Save, save, save – Having a strong emergency fund is even more important than a down payment fund. Emergency funds are your safety net and can prevent late payments and collections.

- Keep your debt payments low – One critical ratio we look at is your Debt-to-Income (DTI) ratio. That’s your monthly debt payments (including child support) divided by your income.

- Keep employment history stable – Income determines how much house payment you can afford. The DTI ratio is part of that. We also need stable income – usually a two-year history. This is especially true for part-time, seasonal, commission, overtime, self-employment, and other fluctuating income.

- Meet with a mortgage lender, even if you’re not “ready” – I personally love to meet with people a year or more before they’re ready to buy. Most people need some guidance, and I’m here to help!

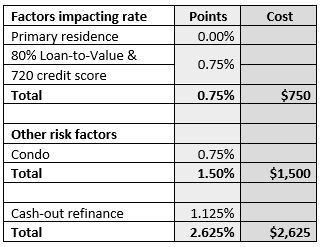

One more note: the rates you see on any bank’s website are generally for the following criteria:

- Credit score of 740 or above

- Loan to Value (the loan amount divided by value of the property) of 60% or less (40% down payment/equity)

- Intention to purchase or take out a no-cash-out refinance

- Primary residence

- 1 unit

Anything other than the above will incur charges from Fannie or Freddie. The charges are a percentage of the loan amount (also called “points”). The points are cumulative and vary based on risk factor. They can be paid at closing as part of the closing costs or figured into the interest rate.

We can use our $100,000 loan amount example to demonstrate this.

As you can see by this example, it is important to be aware of any other factors that might be figured into your personal loan rate. Open communication with your lender will be essential.

Has the Window Closed?

While interest rates have begun to rise, they are still relatively low based on historical context. The real question is, “what can I do to get the best rate available?” By understanding the factors that influence mortgage rates and by focusing on the things you can control, you have the best chance to take advantage of opportunities along your home-owner journey.

If you would like to discuss the mortgage process or learn more about getting pre-qualified or pre-approved for a mortgage loan, reach out to the Mortgage Lending Team at Lake Ridge Bank.