Is Social Security going “bankrupt?"

BY: Paul Zander

Media coverage of Social Security going “bankrupt” has been prevalent for years, but it is not based on reality. Being proactive and taking the following steps can help reassure you that comfort in retirement is still within reach.

In order to make the best decision for you and your loved ones, it is first important to understand the fundamental basics of Social Security. For instance, do you know who funds Social Security? You do! Employers and employees each pay 6.2% of wages up to the maximum taxable amount, which was $147,000 in 2022.1 So unless you and everyone else decides to stop working, there will likely be some sort of Social Security benefits being paid out now, and in the future.

The current challenge for social security is that the FICA taxes being collected are no longer enough to cover the benefits being paid out, so the shortfall is now coming from the social security trust fund. According to the 2022 Social Security Trustees Report, if no changes are made, this trust fund is expected to be exhausted by 2034. However, the report also estimates that the actuarial deficit for the trust, under the intermediate assumptions, is 3.42% of taxable payroll for the 75-year period through 2096. Obviously, raising taxes or reducing social security benefits are not popular changes for a politician to make, but once they pressed to act, these changes are more likely to be a minor tweak than a major adjustment.

As far as qualifying for social security retirement benefits, you must have at least 40 qualifying quarters of work history. Your 35 highest-earning years, adjusted for inflation, are then used to calculate the Social Security benefit you will receive. The average person who worked all their adult life might expect social security to replace about 35%-40% of their income at full retirement age.

In 2022, the maximum monthly benefit at full retirement age is $3,345.00. The average monthly benefit for a retired worker is $1,657, for a retired married couple who both worked is $2,753.00 and is $1,553 for a surviving spouse.1 Once you turn on your benefit, it will also adjust annually for inflation. In fact, 2022 saw an increase of 5.9% and it is projected that there will be another increase of 8.7% in 2023,4 which will be the largest increase in 40 years.

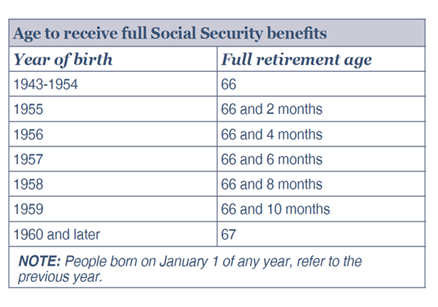

Many of us question when is then best time is to start taking benefits. Although, according to the Social Security Administration, the most common age people start collecting at age 62 (34.3%), there are also many who wait till Medicare eligibility at age 65 or their full retirement age.2 Below is a chart showing exactly what “full retirement age” looks like for those in 2022. These numbers have changed over the years and will likely change again as the mortality rate continues to rise. Depending to your claiming method, it may also be possible to increase the amount of your monthly benefit by holding off on receiving benefits until as late as age 70, so that is an option some filers choose as well.

If you draw your social security benefits prior to your full retirement age, not only will you receive a reduced benefit, you will also be limited on the amount of earnings you can receive through employment. If these earnings limits are exceeded, it could be determined that you were overpaid by social security and your monthly payments could cease until that that amount is paid back. Once you reach your full retirement age, these earnings restrictions no longer apply. Types of income that could impact your social security benefit are wages, bonuses, commissions, business income and stock options. Unearned income like unemployment, workers compensation, pensions, annuities, rental income, inheritance and withdrawals from an IRA or 401k do not affect the earnings limit.

The National Center for Health Statistics says that 49% of people currently aged 65 will live to at least age 85, and 28% will live to age 90.3 If you choose to follow the majority and retire at age 62, that gives you 28 years in retirement. Depending on the circumstances, Social Security may be enough, but most will need some sort of supplemental income.

We haven't even started talking about taxation, whether it "pays to delay", the spousal, survivor, divorcee or family benefits that may be payable, or what those retirement income strategies are. There are many things to consider when determining your financial future, and that is why we recommend consulting with a Certified Financial Planning Professional TM or another trusted professional. "Remember a good plan starts with a good conversation.”

- https://www.ssa.gov/news/cola

- Social Security Administration

- National Center for Health Statistics, 2011; US Life Tables, September 2015. Most recent data available.

- https://www.cnbc.com/2022/10/20/what-8point7percent-social-security-cola-for-2023-means-for-taxes-on-benefits.html