Economic Monitor: The Sky Is Not Falling

BY: Mark Drachenberg

In the beloved children’s folk tale, Chicken Little famously tells anyone who’ll listen that the sky is falling. If you close your eyes and listen to the talking heads at Fox Business, CNBC, or Bloomberg Radio on any given day, you’ll hear a similar refrain: “The economy is cratering,” “We’re already in a recession,” “The markets are crashing…” On and on and on.

It’s easy to forget, amid all the noise, that the primary job of those so-called experts is to sell ad space. But like Chicken Little, who arrived at his conclusion after an acorn fell from a tree and hit him in the head, there’s a reason for their prognostications. Economists everywhere are feeling acorns hit their heads in the form of inflation, rising interest rates, a more hawkish Fed, supply-chain issues, and labor woes. No wonder the dreaded “R” word (recession) has become a major topic of discussion.

Is the sky falling? Are we in a recession? What’s really going on? These are all good questions that we’ll attempt to answer below. Cover your head, if you must, but read on.

Financial Markets

If one focuses only on returns in the major markets, they could be forgiven for thinking the worst. June capped another terrible quarter and the worst first half of a year since 1971. The Dow Jones Industrial Average declined 6.56% for the month and is down 14.44% year-to-date and 9.05% for a full past year. To varying degrees, the story is the same for the S&P 500, 400, and 600 indexes, while the EAFE and NASDAQ have fared worse. Bonds, normally a safe haven in volatile times, dropped 1.57% in June, down 10.35% YTD and 10.29% for the past year, as measured by the Bloomberg U.S. Aggregate Bond Index. In essence, it’s a bear market pretty much across the board.

While no one knows for sure, there are some signs that we may be nearing a bottom. Investor sentiment is a contrarian indicator in that, the lower the number, the more bullish the signal, and vice versa. That number recently bounced off all-time lows (but it’s still quite low). As of this writing, the percentage of stocks trading under the value of their cash holdings is approximately 12% (the highest reading in at least 30 years), indicating that investors have capitulated on their riskier growth investments. Investor capitulation is one sign that market prognosticators point to when saying the market may have bottomed.

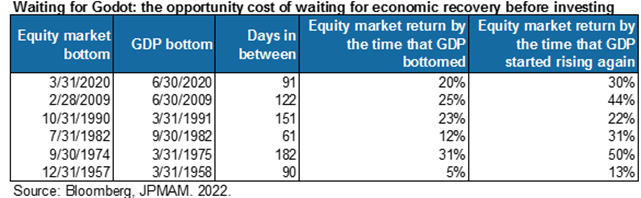

Finally, while we don’t know whether we’re in a recession or not (sometimes it’s not clear until well after it’s begun), historically, the markets tend to bottom prior to the end of the economic downturn. Here’s a chart that details how the markets have performed in previous recessions:

If nothing else, we’re certainly closer to the bottom than we were at the start of the year, indicating this may be a better time to invest.

Economy

Similar to how Chicken Little convinced some of his friends to join in on his fearmongering, certain economists and professional money managers have been lining up to proclaim that the economy is crashing and a recession is imminent, if not already here. It’s uncertain whether these individuals genuinely believe what they’re saying or are just trying to be controversial to make themselves heard, but either way, they’re probably doing more harm than good. Yes, inflation remains high (though it may be nearing or past its peak), as do interest rates (on the plus side, that means higher savings rates; on the down, increased lending rates), but jobs are plentiful, wages continue to rise, and supply-chain issues are improving.

- Gross Domestic Product (GDP): GDP fell at a rate of 1.6% in Q1, and estimates for Q2 are running flat to negative. By some measures (two consecutive quarters of GDP contraction), this would indicate that we’re in a recession. Official estimates from the National Bureau of Economic Research consider more detailed data, and at this point, they’ve not indicated that we’re in a recession. Government spending is a big part of GDP, and the fact that spending is coming down dramatically (as compared to the last couple of years) means that a sizable portion of GDP is having a negative impact on the data, or at best, a minimal positive impact. However, consumer and business spending have continued to grow, and the U.S. economy continues to create new jobs, helping to keep the unemployment rate low. While an acorn may have fallen, the sky isn’t coming down.

- Inflation: With the economy cooling a bit, prices of many commodities – like oil, gas, lumber, many agricultural products, and copper – have started to fall. Despite this, it will take some time to get back to the 2% Fed target for inflation. Supply chains have improved, which has reduced shipping costs for both consumers and businesses. Further improvement may be dependent upon what takes place in China over the coming months. China goes through periods of heavy regulation and fiscal constraint, followed by policy easement. With the heavy restrictions the Chinese government placed on the country’s economy to combat Covid, supply chains were disrupted. With new elections this fall in China, the feeling is that the government will lift the restrictions to ramp up growth and stay competitive internationally. If that happens, supply chains should ease and the part of inflation that is transitory should ease, too.

- Unemployment: The participation rate is increasing, meaning more people are back on the job or looking for one. With continued strong demand for workers, higher wages and better benefits have followed suit. As long as these numbers remain strong, it’s hard to argue that we’re in a recession.

- Other: Many areas of the economy continue to show strength. Three metrics are particularly notable: hotel occupancy, TSA checkpoint data, and global commercial flights. While all three have reached new recovery highs, they remain below pre-COVID levels.

Fed Watch

The Fed is still front and center in the fight against inflation, having raised the Federal Funds rate by 75 basis points in June, to a range of 1.50% to 1.75%. Expectations are that it will continue to ramp the rate up to 3.00% to 3.50% by the end of this year or early next, before taking a break. A lot will depend upon how it reads the economic tea leaves, but for now, expect the Fed to continue its hawkishness.

Fears are growing, however, that the Fed may go too far in raising rates and drive the economy into a deeper recession than necessary. Those fears are perhaps outweighing one that it will stop raising rates too soon. The Fed is trying to be transparent, but this is a fluid situation and things change continually. The markets like certainty, so hopefully there aren’t too many surprises out there. For now, the sky isn’t falling.

Outlook/Summary

Simply put, things aren’t as gloomy as some would lead you to believe. We just celebrated our nation’s 246th birthday, and while there is a lot of political divisiveness, this is still the greatest country on earth, and the opportunities that await us as a nation are boundless. Let’s all take a moment, count our blessings, get to work, and look forward to the brighter days ahead!

We’ve said it before and will say it again: it never pays to time the markets. There are some adjustments, however, that can be made to manage the downside while staying fully invested. Utilizing floating-rate funds and a laddered individual bond portfolio can provide some protection and a growing stream of income on the fixed income side. Strong companies with healthy dividends continue to work on the equity side, along with tools like hedged equity funds. Dollar-cost averaging can also provide some long-term benefits.

If the data is correct that we’re at or near a bottom in the markets, now may be a good time to put some money to work. We continue to note the wisdom of Warren Buffett: “It is better to be fearful when others are greedy and greedy when others are fearful.” We also continue to monitor the Fed, the economy, and other news as we enter the third quarter, to assess their collective impact on portfolios. To discuss your portfolio, please contact me or anyone in our Wealth Management department at (608) 826-3570. We look forward to speaking with you soon!